marin county property tax due dates 2021

The deadline to file a Request for Penalty Cancellation is May 6 2021. Establishing tax levies estimating property worth and then receiving the tax.

Michelle Mccarthy Owner Bungalows Of Marin Linkedin

The first installment is due November 1 and must be paid on or before December.

. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in. Property tax bills are mailed annually in late September and are payable in two installments. Property tax due dates are not expected to change as a result of the.

San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm. The Tax Collector is located at 3501 Civic Center Drive Room 202 in San Rafael. Taxpayers are being asked to pay online by phone or by mail rather than in person at the Marin County Civic Center to avoid.

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 1. If you purchase real property during the tax year you are responsible for any taxes not paid as of the close of escrow. Duplicate bills are available on request.

Last day for owners to apply for class 1c or 4c 5 resort classification. You may request a Business Property Statement either in person in writing or by phone. Both installments may be paid with the first installment.

The first installment of property taxes is due nov. Property tax due dates are not expected to change as a result of the COVID-19 pandemic. County of Marin MARIN COUNTY CA Marin Countys 2020-21 property tax.

Monday April 12 a date not expected to change due to the COVID-19 pandemic. Search for real and personal property tax records find out when property tax payments are due accepted payment methods tax lien sales and property tax rebate programs offered by the city and county of denver. Assessment date for both real and personal property.

Property tax bills are mailed annually in late September and are payable in two installments. 10 to avoid penalty. Taxpayers who do not pay property taxes by the due date receive a penalty.

Property tax payments are made to your county treasurer. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. 21 rows First installment secured real property taxes due.

This coming Monday December 12 is the last day to pay the first installment of Marin County property taxes. 1 and must be paid on or before Dec. San Rafael CA Marin Countys 2021-22 property tax bills 91854 of them were mailed to property owners September 24.

All secured personal property taxes. Taxing units include city county governments and various special districts such as public schools. The Tax Collectors online.

Overall there are three stages to real estate taxation. The county estimates it will lose more than 900000 in late penalties if it grants all the applications for coronavirus waivers. Staff is available during office hours to assist you.

Second Installment Of Property Taxes Due San Rafael CA Monday April 11 is the last day for property owners to pay the second installment of their 2021-22 property. Please call the Treasurers Office 702-455-4323 to. This years tax roll of 1262606363 is up 319 over last year.

Last day to file for tax-exempt status with the assessor. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. Reply 1 The first installment of property taxes is due Nov.

Tax bills are mailed only once each year. Revised tax bills may have different due dates so. Marin County taxpayers are being asked to pay online by phone or by mail rather than in-person.

How to request a Business Property Statement. The first installment is due Nov. Marin County Officials.

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Marin County collects on average 063 of a propertys assessed fair market value as property tax. Office visits are by appointment only.

The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. 10 to avoid penalty. Our phone number is 415 473-7208.

You can call the Assessors Office at 415 473-7215 or send email. Property tax payments at the Marin County tax office. Our mailing address is Marin County Assessor PO Box C San Rafael CA 94913.

Send the correct installment payment stub 1st or 2nd when paying your bill. Local property tax revenues are needed now more than ever. File by may 31 2021.

The normal office hours are 9am to 430 pm weekdays. Both installments may be paid with the first installment. The second installment must be paid by April 10 2021.

Online or phone payments recommended by Tax Collector. For contact information visit. September 28 2021 at 411 pm.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. They all are legal governing units managed by elected or appointed officers. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of.

1 and must be paid on or before Dec. The Nevada legislature has established four tax installment due dates for each fiscal year July 1 to June 30 as shown above. Penalties apply if the installments are not paid by December 10 or April 10 respectively.

Assessment date for both real and personal property. First Installment of Property Taxes Due Monday 121216. Questions about assessed values are best answered by the County Assessor.

September 27 2021 at 642 pm. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm. The second installment must be paid by April 10 2021.

Permanent Road Division Prd Program Marin County Public Works

Student Elections Ambassador Program Elections County Of Marin

Marin County California Va Home Loan Information Va Hlc

Marin County Multi Jurisdictional Local Hazard Mitigation Plan

Marin County Allocates 1m To Cover New Prop 19 Duties

Santa Clara County Ca Property Tax Search And Records Propertyshark

Editorial Time To Support Cautious Tax Increase For San Rafael Schools Marin Independent Journal

Job Opportunities Career Opportunities At Marin County Superior Court

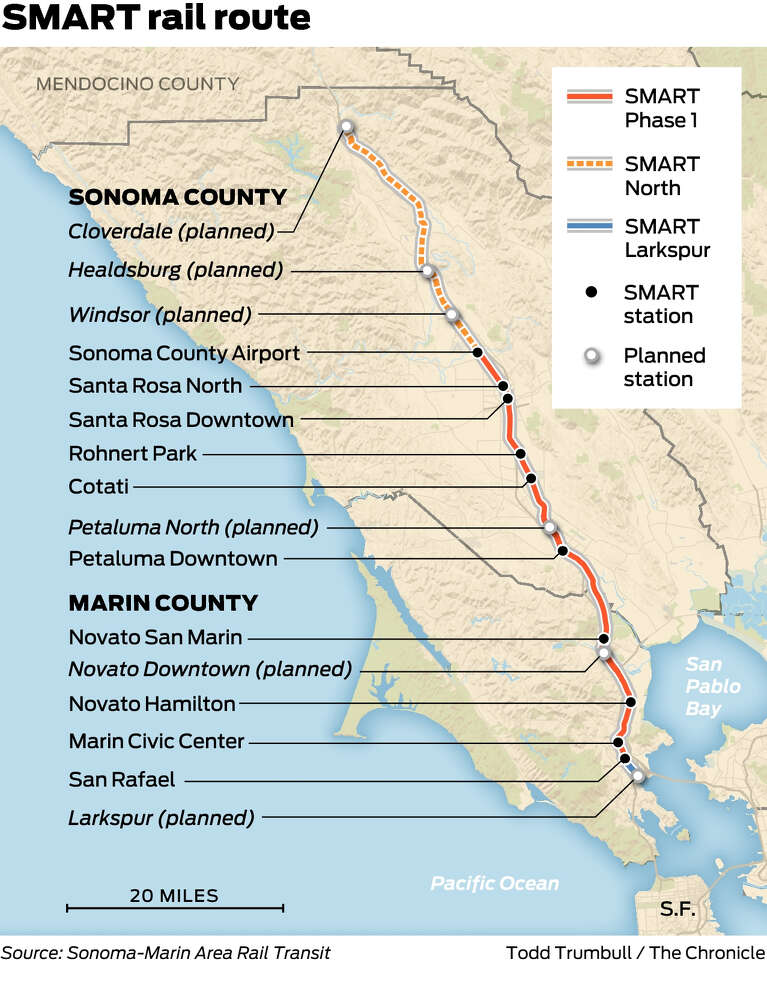

North Bay S Smart Train Beloved But Not Bustling Looks To Extend Sales Tax

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

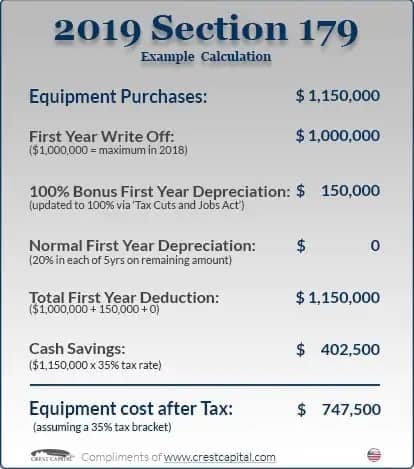

Section 179 Tax Deduction Marin County Ford

Alameda County Ca Property Tax Search And Records Propertyshark

Eligibility Worker I Bilingual Job Details Tab Career Pages

Marin Supervisors Approve 682 6m County Budget

2022 Best Places To Buy A House In Marin County Ca Niche

Recent Blog Posts Central Marin Fire Department Easyblog