how much is inheritance tax in oklahoma

Arkansas has no estate or inheritance tax. We are open 24 hours a day 7 days a week.

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

. She knew that she had to use various trust funds to avoid probate and an inheritance tax when when she passed. If the inheritance tax is paid within three months of the decedents death a 5 discount. Yrs Ive been trying to get legal help to no prevail.

Arkansas Capital Gains Tax. How Much is Inheritance Tax. Upon the death of a property owner Oklahoma law provides for a legal process to take control of the deceased owners probate assets assess their value pay creditors and distribute the assets to the persons legatees if the person died with a will or heirs if the person died without a will.

What is meant by probating an estate. How much each relative will receive through inheritance succession depends on the state in which probate is conducted. Learn more about Probate Laws in your state.

In Oklahoma the median property tax rate is 899 per 100000 of assessed home value. 1-800-959-1247 email protected 100 Fisher Ave. Although the order of succession is somewhat uniform throughout the states the laws regarding how the estate is apportioned in terms of percentages can vary widely.

The gas tax in Arkansas is 245 cents per gallon of regular gasoline and 285 cents per gallon of diesel. Oklahoma state income tax rates range up to 5. 952 White Plains NY 10606.

Inheritances is also exempt from the Arkansas income tax. Capital gains are taxable as personal income in Arkansas. Oklahoma does not provide legal representation for disabled people at allfor 13.

Learn Oklahoma tax rates for income property sales tax and more to estimate how much you will pay in 2022. Arkansas Gasoline Tax. Such procedures take place in the district court.

According to Vanguard the people who inherit your Roth IRA will have to take annual RMDs but they wont have to pay any federal income tax on their withdrawals as long as the accounts been open. At this point I have found out that the trust that was established in 1993 was terminated. How Long Does It Take to Get an Inheritance.

In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax. If you have extra retirement funds and worry about your heirs facing tax liability on an inheritance converting to a Roth IRA can make sense. How much tax revenue is raised in the US.

Holographic Wills In Wagoner County Giải Quyết Di Chuc

Federal Estate Tax Exemption 2021 Cortes Law Firm

Do I Need To Pay Inheritance Taxes Postic Bates P C

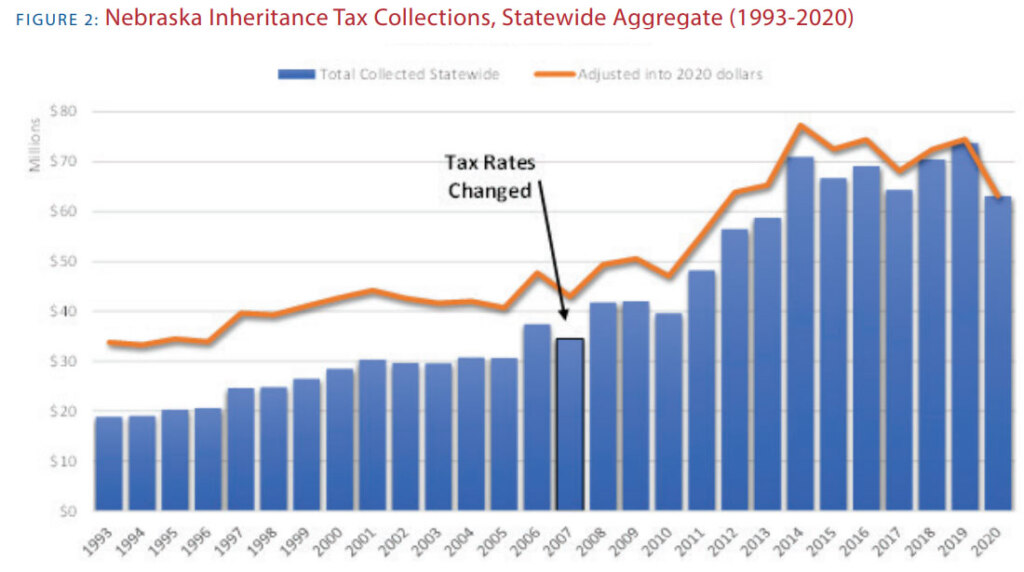

Death And Taxes Nebraska S Inheritance Tax

Is There A Federal Inheritance Tax Legalzoom Com

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Do I Need To Pay Inheritance Taxes Postic Bates P C

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Death And Taxes Nebraska S Inheritance Tax

Oklahoma Estate Tax Everything You Need To Know Smartasset

Oklahoma Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Indiana Estate Tax Everything You Need To Know Smartasset

Death And Taxes Nebraska S Inheritance Tax

Inheritance Tax How It Works How Much It Is Bankrate